Will Net Zero cost you money?

“Does Net Zero cost money?” That’s a question someone asked at a workshop I was facilitating last week. Everybody around the table nodded.

“Hold on,” I said “You’ve just been telling me about all the wonderful things you have been doing – upgrading your compressed air systems, solar power purchase agreements, LED lighting systems – which have saved carbon and saved money?”

“Yes, but we did that for financial reasons, not for the environment.”

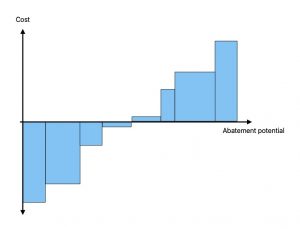

To attempt to resolve this dichotomy, I sketched a MAC curve – this shows the ‘marginal abatement cost’ for a range of actions. Here’s what a MAC curve typically looks like (better than my rough sketch at the workshop!).

As you can see, some actions deliver massive cost savings and carbon savings, others are more or less cost neutral and some cost quite a bit of money per tonne carbon abated. My delegates were subconsciously dividing the curve along the X axis and saying the actions below the line were purely financial and those above were ‘Net Zero’. This creates a self-fulfilling prophecy – if you define Net Zero as anything that costs you money, then Net Zero will cost you money.

Ideally, we want to net these two parts of the graph against each other, but the artificial split is a persistent negative mindset which I find people often retreat to.

The other problem is that this graph cannot show the less tangible but very real indirect economic benefits of a good Net Zero performance – recruiting, retaining and motivating employees, competitive advantage in the market place, attracting investors etc. These can outweigh the direct costs many times over. And you could argue that those benefits accrue more for actions in the upper half as many of those below are seen as a bit boring or incomprehensible to the layperson (“Tell me about your power factor correction again” says nobody ever).

So, how do you square this circle?

You can embrace it, using a two stage assessment process:

- Every project is assessed first against standard return on investment/payback criteria. If it meets the threshold then fund it out of standard investment budgets (and thus protect your Sustainability budget).

- Projects which fail that ROI threshold but which have clear Sustainability characteristics are then considered against a Sustainability budget where the criteria meeting Sustainability targets. You could sweat the MAC curve to get maximum bang for your buck, but you might want to fund the occasional ‘green bling’ project if you need a visible totem for your Sustainability programme.

Fundamental to this is understanding the business case for Sustainability as it applies to your organisation. This is why ‘The Sweetspot of Sustainability Success’ the first session of our annual Net Zero Business Academy programme.